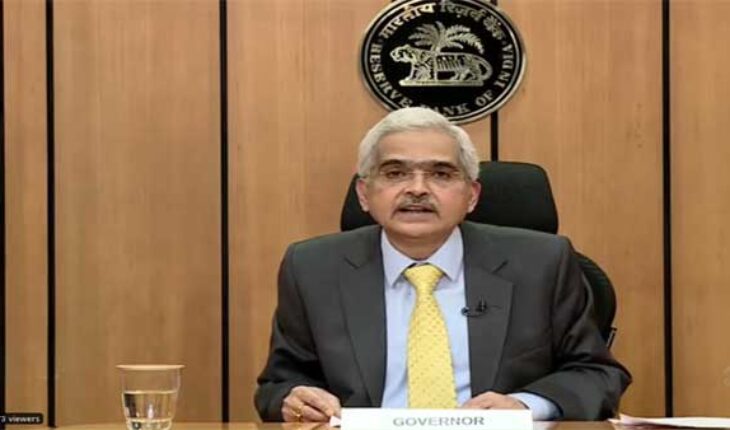

Reserve Bank of India’s Governor Shaktikanta Das recently has said that the central bank is constantly monitoring the “Business Model” of Indian Banks. In fact, after the bankruptcy of two US banks, Silicon Valley Bank (SVB) and Signature Bank and Credit Suisse Bank of Switzerland in Europe, Union Finance Minister Nirmala Sitharaman held discussions with the Bank Chiefs on March 25, 2023, so that banks may stop the incoming danger in front of them if any. In this sequence, the finance minister has asked the Reserve Bank of India to keep a constant eye on the “Business Model” of the banks, so that immediate corrective steps can be taken if there are any risks seen.

After the bankruptcy of American banks and Switzerland’s Credit Suisse Bank in Europe, a debate has started on the “Business Model” of banks in all over the world, because the strength of both the banks and the economy is important. For this, it is very important and necessary for the “Business Model” of the banks to be healthy, because due to the incorrect “Business Model”, the bank can sink as well as the economy can also be weakened.

The Reserve Bank of India believes that the reason for the sinking of two banks in America and Credit Suisse Bank of Switzerland in Europe is the faulty “Business Model”. However, India’s banking system remains strong, because the “Business Model” of Indian banks is not flawed and that is why global developments have not seen any adverse effect on it and it continues to be strong.

The US-based SVB provided loans to startups, venture capitalists and technology companies in addition to taking deposits from large businesses, while Signature Bank provided loans primarily to real estate in addition to taking deposits. Contrary to banking norms, SVB had given too many loans to a single sector. A large amount of cash was deposited in this bank after the Corona pandemic. Therefore, the bank had invested excess deposits in long-term bonds, but later due to geo-political crisis, inflation, jump in loan interest rates, etc., the asset-liability balance of the bank deteriorated, and the bank was unable to meet the cash requirements of the customers. Similarly, high cash withdrawals by Signature Bank customers led to a liquidity crunch, as the bank accounted for a quarter of the $103 billion in deposits held in cryptocurrencies by September 2022, and has had also kept giving more loans to a particular sector. At the same time, Europe’s Credit Suisse bank sank due to corruption. Since its sinking could have adversely affected the Swiss economy, Union Bank of Switzerland (UBS), the country’s largest bank, took over the bank under the direction of the government.

In the current environment, it is the effort of the Central Government and the Central Bank that the “Business Model” of Indian banks should remain strong even further and due to this, no crisis should arise in the economy. According to Mr. Das, the current “Business Model” of Indian banks may pose a risk to parts of the bank’s balance sheet, but it will not lead to a major crisis among Indian banks. Das also believes that Indian banks will be able to meet the minimum requirement of capital adequacy ratio even in times of adversity or crisis. Despite this, Das has cautioned the bank managements to remain vigilant and regularly assess financial risks while at the same time making constant efforts to maintain capital adequacy and liquidity. Das also said that Indian banks have registered improvement in the recent past on the front of reducing asset pressure, increasing revenue, and increasing profits by reducing gross non-performing assets (NPAs). The NPA ratio of banks to come down to 4.41 per cent in December 2022 from 5.8 per cent in March 2022 and 7.3 per cent as on 31 March 2021.

According to the latest report of Moody’s Investors Service, the asset quality of Indian banks and Southeast Asian countries will remain stable in 2023 and Indian banks will benefit from smooth operations of banking. According to Moody’s, rising interest rates amid high inflation will lead to a gradual increase in margins, which will boost banks’ earnings. Although high debt-servicing costs and weak growth could pose asset risks for banks, Indian banks are currently well equipped to deal with the potential increase in NPAs as they have excess capital and are able to make provisions for NPAs. Moody’s also believes that the inflation rate in India will fall further, which is correct, because inflation in India has come down to a 15-month low of 5.66 percent in March 2023, while inflation is still high in the countries of the world. During the first 9 months of 2022, capital inflows into India have been over 2 per cent of GDP, which is a good sign for both banking and the economy.

Global rating agency Moody’s has upgraded the ratings of 9 Indian private and public sector banks to stable from negative outlook. The banks whose ratings have been upgraded by Moody’s include private sector Axis Bank, HDFC Bank, ICICI Bank and public sector banks Bank of Baroda, Canara Bank, Punjab National Bank, Exim Bank and Union Bank of India. The rating upgrade of Indian banks by Moody’s means that the risks associated with the Indian banks are coming down.

The circumstances of Indian banks are different from the banks of America and Europe. Indian banks are working according to regulatory and own policies, and they make new loan policy every year. Therefore, they cannot lend to any one sector or industry at any cost. The regulator also keeps on continuously reviewing the functioning of the banks.

Indian banks cannot use the entire deposit amount of the customers for giving loans. In this case, banks have to keep a certain amount with the Reserve Bank as a reserve or cushion.

Furthermore, all banks work by maintaining an asset-liability balance. reserve Bank of India; Always works to maintain liquidity in the banking system. Apart from this, the Indian economy has remained strong even amid the Corona pandemic and the global recession.

The Indian banking system has remained resilient in the face of all odds. It has not been affected by recent events in the global financial ecosystem. In such a situation, it would be appropriate to say that the “Business Model” of Indian banks is very strong and for this reason the bankruptcy of foreign banks did not affect Indian banks and there is a strong possibility of Indian banks remaining strong in the future.

Satish Singh, Mumbai based Senior Journalist, Views are personal. Mobile No.8294586892