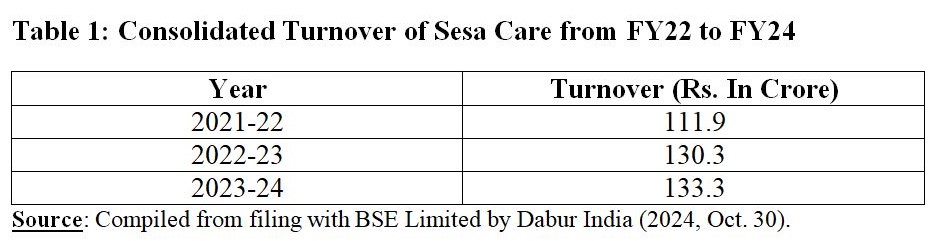

On May 26, 2025, Dabur India’s Board of Directors approved the amalgamation of Sesa Care. Through this transaction, Dabur India filled a key whitespace in its existing hair oil portfolio while improving the growth prospects of the combined entity in the hair oil segment. On October 30, 2024, Dabur India Limited (‘Dabur India’) had proposed acquisition of Sesa Care Private Limited (‘Sesa Care’) through merger along with its foreign wholly owned subsidiary in Bangladesh, viz. Sesa Care Bangladesh Pvt. Ltd. Consolidated turnover of the target company for FY23-24 was Rs. 133.3 Crores. Paid-up capital of Sesa Care stood at Rs. 958.28 Crores. The transaction was to be completed in 15-18 months.

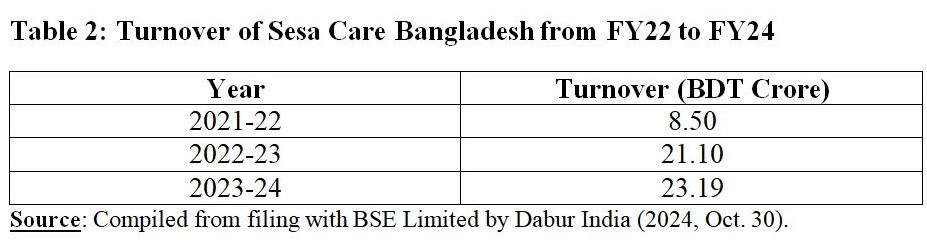

Sesa Care Bangladesh had paid-up share capital of BDT 3.40 Crores. Turnover for FY23-24 stood at BDT 23.19 Crores. SESA Bangladesh was incorporated on 16.03.2020. (Exchange rate between Indian Rupee and Bangladeshi Taka on October 30, 2024: 1 INR = 1.40 BDT))

Sesa Care held 3rd position in the ayurvedic hair oil category with a market share of about 11.0 per cent in Indian market. For Dabur India, this transaction presented a strategic opportunity to expand its presence in the Rs. 900 Crore ayurvedic hair oil market. Ayurvedic product formulations of Sesa had certification from Department of Ayurveda. Besides this, products were formulated using old ayurvedic composition comprising 18 herbs, 5 oils, pure cow milk, and boiling for 22 hours.

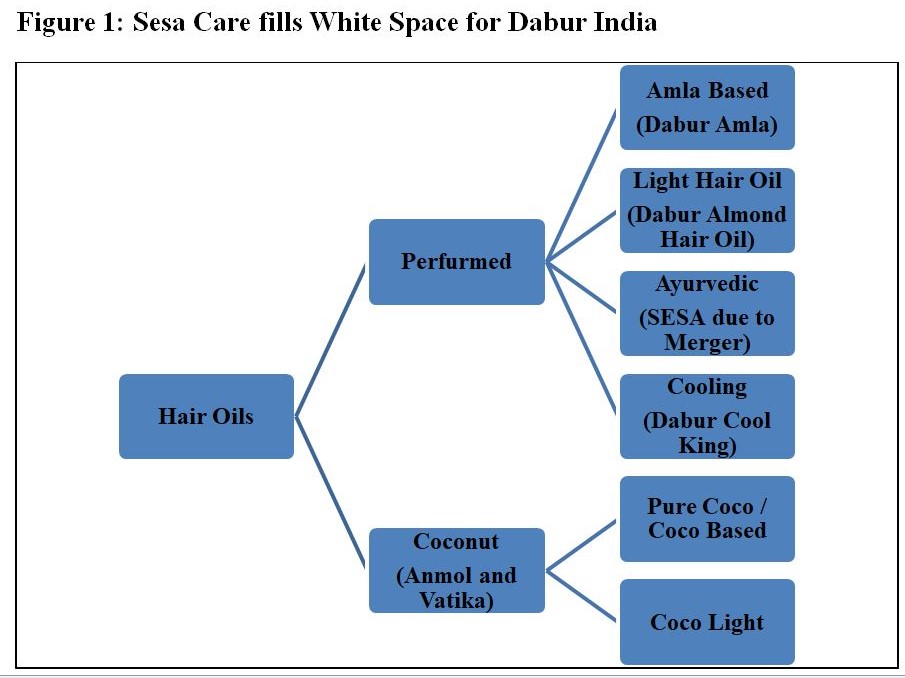

For Dabur India, acquisition made sense as it has 140 years of legacy, and its portfolio has 250+ ayurvedic products. Hair Care business of Dabur comprises pre-wash, in-shower and post-wash products such as hair oils, shampoo, in-shower conditioners, hair styling and hair serums. Dabur India is currently known as the world’s largest Ayurvedic and Natural Health Care company with leadership position in Hair Oils – No. 1 position in Amla with Dabur Amla Hair Oil and No. 1 position in hair oils, No. 2 in Almond with Dabur Almond Hair Oil, and No. 3 in Coconut with Dabur Anmol and Dabur Vatika. Dabur ended the FY24 with its highest-ever share of Hair Oil at 17.2 per cent. Sesa Care deal will further strengthen position of Dabur India as by March 31, 2024, the company held a dominant position with 75.0 per cent share in Hair Oils, 65.5 per cent in Hair Creams and 65.9 per cent in Hammam Zaith that puts Dabur as the leading hair care company in Egypt through its subsidiary – Dabur Egypt Ltd., Egypt.

The company is well-placed with its distribution network, supply chain, differentiated & strategic customer relationships across Channels, and international presence. Dabur India has 21 manufacturing units, and has presence in 120+ countries across 4 continents. The company has 26 C&FAs and 4 Mother Warehouses, and product range reaches 7.9 million retail outlets. The company added 40,000 Chemists in 2023-24 alone thereby taking the total reach to 2,72,000. Dabur brands are available in 4.8 lakh cosmetic outlets across India, and 50 lakh outlets in rural India.

Enterprise Value of Sesa Care was estimated to be in the range of Rs. 315-325 Crores which included debt of Rs. 289 Crores. Sesa had an EBITDA margin of about 13.0 per cent. Sesa Care owned a manufacturing facility at Paonta Sahib in Himachal Pradesh. Hence, the Enterprise Value (EV) was put at 2.4x in terms of Enterprise Value (EV)/Sales, and 19-20x in terms of EV/EBITDA.

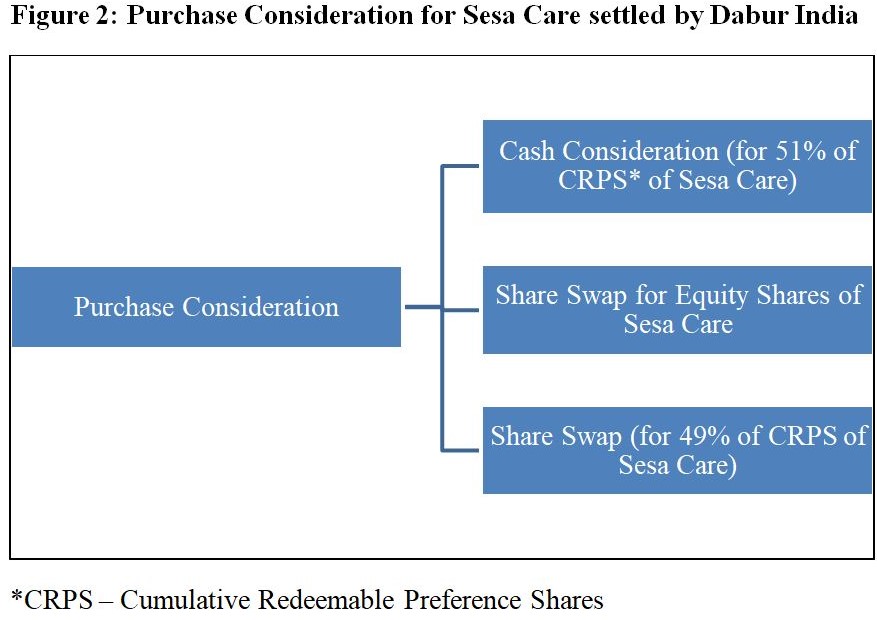

For Dabur India, it meant ‘Cash Consideration’ or Rs. 12.6 Crore for purchase of 51% of the total paid up Cumulative Redeemable Preference Shares (CRPS) of Rs. 10 each of the Target Company from its existing shareholders. ‘Share swap’ for the equity shares and remaining 49% of the total paid up CRPS of Sesa Care. Dabur India also took over debt liability of Rs. 289 Crore by extending Corporate Guarantee (CG).

True North, India’s leading home-grown Private Equity fund formed a new entity – Sesa Care Private Limited with majority stake (75.0 per cent). D. K. Patel, the founder, kept the remaining stake. Ban Labs was formed in 1966, and had headquarters in Rajkot, Gujarat. Under the Chairmanship of its Founder, Dr. D. K. Patel, it was initially called ‘Bharatiya Aushadh Nirmanshala’, and became ‘BAN Labs’.

Besides Sesa Hair Oil, Ban Labs had other products in its portfolio including Dr’s Care detergent and dishwash liquid and Charm & Glow skincare products. Ban Labs had a revenue of about Rs. 240 Crores at that time. When Sesa Care decided about merger with Dabur India then its product portfolio included Sesa Ayurvedic Oil, shampoos, conditioners, etc. In this way, Sesa had legacy of many decades.

Prior to this transaction, two major deals took place which included acquisition of Kesh King by Emami Limited from SBS Biotech in 2015, and acquisition of Indulekha Hair Oils by Hindustan Unilever Limited from Kerala-based Mosons Extractions.

Dabur India has Dabur Anmol Coconut Oil that is among 8 brands of Dabur in Rs. 100 Cr.-Rs. 250 Crore in size, Dabur Sarson Amla Hair Oil which is among 4 Dabur brands of over Rs. 250 Cr.-Rs. 500 Crore in size. Dabur Vatika and Dabur Amla figure among 4 brands of Dabur India having a turnover of more than Rs. 1,000 Crore. Overall, revenue from Operations of the company stood at Rs. 12,404 Crore for FY2023-24. Sesa Care is likely to be value accretive for Dabur India due to its strong presence in Hair Oil space.

Dr. Anil Kumar Angrish- Associate Professor (Finance and Accounting), Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.