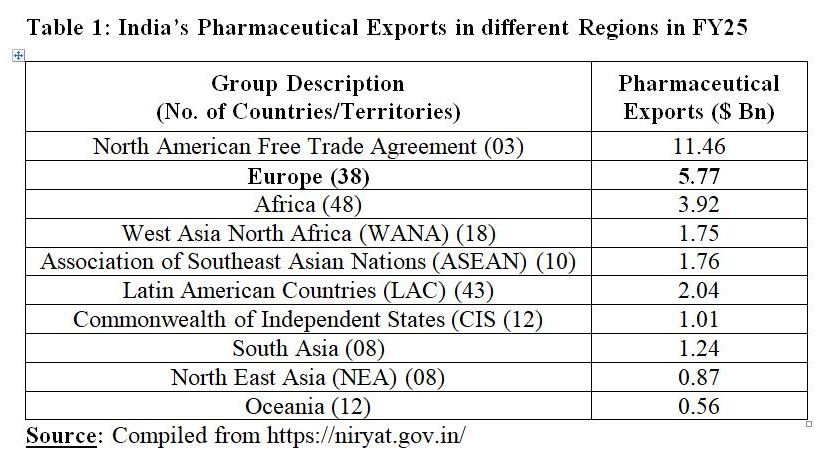

India is negotiating free trade agreement (FTA) with the European Union (EU). FTAs have implications for all those sectors which are export-intensive or import-intensive, and pharmaceutical sector is not an exception. European region is an important market for pharmaceutical exports from India. In FY25, India exported Drugs and Pharmaceuticals worth $5.77 Bn to Europe. Europe is the second largest market for Drugs and Pharmaceuticals from India after NAFTA that comprises the United States of America (USA), Canada, and Mexico. Within Europe, United Kingdom (UK) is the major market for Indian pharma products. In FY25, export of Drugs and Pharmaceuticals from India to the UK stood at $913.97 Mn.

In the wake of tariff war, bilateral trade agreements (BTAs) are being considered the way to go ahead in the new world order. India – UK Free Trade Agreement (FTA) is the move in that direction as it became India’ 15th trade deal for which talks started in January 2022 and culminated on May 6, 2025. This comprehensive agreement covered 99 per cent of the tariff lines as stated by the President of Confederation of Indian Industry (CII). Implications are also wider as the 5th and the 6th largest economies in the world have come together for this FTA. Recently, International Monetary Fund (IMF) projected that India is poised to become the world’s fourth largest economy in 2025, with India’s projected GDP of US $4,187.02 Bn at current prices, narrowly surpassing Japan’s estimated GDP of $4,186.43 Bn.

The UK is the second largest market for India’s pharmaceutical exports. The UK remains the largest market for India’s pharmaceutical exports in 38 European countries/territories. For FY25, UK’s share stood at 3.01 per cent of India’s total pharmaceutical exports to the world. The USA remained the largest export market for India’s pharmaceutical products with a share of 34.61 per cent.

In this FTA, one key demand of ‘data exclusivity’ provision has not been accepted by India, and this provision has implications for Indian Pharmaceutical Industry. Data Exclusivity was extensively dealt by the Committee comprising Mrs. Satwant Reddy, Secretary and Mr. Gurdial Singh Sandhu, Joint Secretary in the Department of Chemicals & Petrochemicals, Ministry of Chemicals & Fertilizers in their report submitted on May 31, 2007, regarding ‘Steps to be taken by Government of India in the context of Data Protection Provisions of Article 39.3 of TRIPS Agreement’. The Committee listed two types of protections, i.e., Trade Secret as a form of Protection and Data Exclusivity as a form of Protection.

Article 39.3 of the agreement on Trade-related Aspects of Intellectual Property Rights provides – ‘Members, when requiring, as a condition of approving the marketing of pharmaceutical or of agricultural chemical products which utilize new chemical entities, the submission of undisclosed test or other data, the origination of which involves a considerable effort, shall protect such data against unfair commercial use. In addition, Members shall protect such data against disclosure, except where necessary to protect the public, or unless steps are taken to ensure that the data are protected against unfair commercial use.’

Satwant Reddy Committee stated that under Data Exclusivity as a form of Protection, the Regulatory Authority cannot rely on the data submitted by the Originator for approving the second and subsequent applications for the same product. This concept implied ‘non-disclosure’ as well as ‘non-reliance’ on the first applicant’s data by the Regulatory Authority at the time of granting marketing approval to the subsequent applicants. Further, the Committee had underlined that under Article 39.3 of the TRIPS Agreement, India is under no obligation to provide Data Exclusivity as it may be TRIPS-plus as Article 39.3 contained two obligations namely ‘Protection against Disclosure’, and ‘Protection against Unfair Commercial Use’.

On pharma sector, the relevance of Data Exclusivity was highlighted when the Committee observed that ‘over the years Indian pharma industry has developed a strong capability as a producer of good quality low priced generic medicines and any exclusivity provisions may adversely affect the interests of domestic industry and lead to increase in prices of medicines in the country.’ Specific emphasis was laid on anti-HIV/AIDS drugs to be available at low prices.

Prominent UK-origin pharmaceutical companies have presence in India. Companies such as AstraZeneca (Headquarters: Cambridge, UK), GSK (Headquarters: Brentford, UK) are innovator pharma companies and figure among top 20 pharmaceutical companies in the world. AstraZeneca Pharmaceutical AB, Sweden is the holding company of AstraZeneca Pharma India Limited (AZPIL). AstraZeneca PLC is the holding company of AstraZeneca Pharmaceutical AB, Sweden. AZPIL was established in 1979 with headquarters in Bengaluru, Karnataka.

Promoter and Promoter Group holds majority stake in GlaxoSmithKline Pharmaceuticals Limited in India. Promoter and Promoter Group comprises Glaxo Group Limited, U.K. (35.99 per cent), GlaxoSmithKline Pte Limited, Singapore (28.10 per cent), Eskaylab Limited, U.K. (6.94 per cent), and Burroughs Wellcome International Limited, U.K. (3.97 per cent). GSK has long association with Indian market as in 1924, H. J. Foster & Co. Limited introduced formula milk in India. Later, H. J. Foster & Co. became Glaxo Laboratories.

Data Exclusivity is not expected to be a material concern for those pharmaceutical companies which do not have significant investment in Research and Development (R&D) in India. For example, AstraZeneca has 6 strategic R&D centres in the UK (Cambridge), US (Gaithersburg, Maryland, and Boston, Massachusetts), Sweden (Gothenburg) and China (Shanghai, and Beijing). The company has an active R&D presence in 50+ countries otherwise.

Low Research & Development (R&D) expenditure by pharma companies in India reflects the relevance of Data Exclusivity for those pharma companies. So, the countries to which these companies belong, are also not likely emphasize on Data Exclusivity. GlaxoSmithKline Pharmaceuticals Limited had a recurring expenditure on Research and Development of Rs. 254.37 Lakhs in FY24, up from Rs. 190.99 Lakhs. This sum is meagre in comparison to the total sales of the company amounting to Rs. 3,385.94 Crore for the year ended March 31, 2024 (up from Rs. 3,181.40 Crore for the year ended March 31, 2023).

To conclude, India has successfully prevented the inclusion of ‘Data Exclusivity’ in UK FTA. In a way, interests of domestic pharma industry have been protected. This is worthwhile to note that UK FTA is second such agreement in recent past in which Data Exclusivity provisions have not been agreed upon. In 2024, India signed free trade agreement with European Free Trade Association (EFTA) that comprises four countries namely Iceland, Liechtenstein, Norway and Switzerland. In FTA with EFTA too, India had rejected the inclusion of Data Exclusivity clause. Among EFTA members, Switzerland is only major leading exporter of pharmaceutical products as the country is home to prominent pharma companies such as Roche, Novartis, Lonza, among others.

Dr. Anil Kumar Angrish- Associate Professor (Finance and Accounting), Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.