Companies keep on reviewing ways to increase Shareholder Value by changing the composition of Equity, Liabilities, Assets, and Operations. Through Strategic Alliances, companies form relationships to combine resources, capabilities, and core competencies for certain business purposes. All major Indian pharma companies have their experiences in formation, running and termination of joint ventures (JVs). It is interesting to understand motivations behind these JVs as considerations such as cost reduction, technology sharing, product development, market access or access to capital play important role. JVs add value to collaborating entities without affecting their independent existence. Foreign Direct Investment (FDI) policy has dictated the formation of joint ventures in India, along with other business considerations. In the beginning of 21st century, there were significant ongoing changes in India’s pharmaceutical industry which changed the direction of JVs.

Recent data shows that significant number of top Indian pharmaceutical companies seem less inclined to form joint ventures. By March-end of 2024, at least top 12 pharmaceutical companies figuring among top 25 (excluding pharma companies of foreign origin such as AstraZeneca, Merck, Pfizer, and GSK) in terms of market capitalization had no joint venture, and the list included names such as Ajanta Pharma, Alkem Labs, Emcure Pharma, Gland Pharma, Glenmark Pharma, J. B. Chemicals and Pharma (majority owned by Tau Investments, an affiliate of KKR, a Private Equity firm), Suven Pharma, Piramal Pharma, Eris Lifesciences, Divi’s Labs, Torrent Pharma and Wockhardt Limited.

Subsidiaries have been preferred by these pharma companies as evident from the fact that Eris Lifesciences had four wholly owned subsidiaries, two subsidiaries, and one step-down subsidiary. Divi’s had two subsidiaries (one based in the US, and another in Europe). Wockhardt Limited had 28 subsidiaries, Ajanta Pharma had 4 subsidiaries, and Suven Pharma had two subsidiaries. Torrent Pharma had 17 subsidiaries, out of which 3 were step-down subsidiaries, and had no joint venture as on March 31, 2024. One wholly owned subsidiary – Farmaceutica Torrent Colombia SAS was also incorporated recently on January 3, 2024. But none of these pharma companies had any joint venture.

Among top pharma companies, Sun Pharma had one Joint Venture – Artes Biotechnology GmbH (Germany) with 45.0 per cent equity holding. Cipla’s subsidiary Cipla (EU) Limited has one joint venture – MKC Biotherapeutics Inc., USA which is also a recent one, as this JV was formed on February 27, 2024, with equity proportion of 45.4 : 35.2 : 19.4 among MNI Ventures Mauritius, Cipla (EU) Limited and Kemwell Biopharma UK Limited (Aspergen Inc.) to develop and commercialize novel cell therapy products for major unmet medical needs in the USA, Japan and EU regions.

Lupin Limited had just one JV through one of its subsidiaries as on March 31, 2024. This JV, ‘YL Biologics, Japan’ is of Lupin Atlantis Holdings SA, Switzerland with Yoshindo Inc., Japan. Lupin Atlantis held 45.0 per cent stake whereas Yoshindo held 55.0 per cent share of interest in the JV. In March 2025, Laurus Labs entered a JV with KRKA d.d., Novo mesto, Slovenia, the renowned European pharma giant to form Krka Pharma Pvt. Ltd which is based in Hyderabad, India. KRKA holds 51.0 per cent stake and Laurus Labs holds 49.0 per cent stake in this JV. The investment made by both companies is to support the establishment of a cGMP finished dosage form (FDF) facility in Hyderabad.

Zydus Lifesciences had reported four Joint Ventures by the end of FY24, namely Zydus Takeda Healthcare Private Limited (for API with 50.0 per cent stake), Zydus Hospira Oncology Private Limited (for Human Pharma formulations with 50.0 per cent stake), Bayer Zydus Pharma Private Limited (for Human Pharma formulations with 24.99 per cent stake), and Oncosol Limited (for Human Pharma formulations with 50.0 per cent stake). Dr. Reddy’s Labs had two joint ventures namely Kunshan Rotam Reddy Pharma Company Limited, China in which DRL held 51.33 per cent stake, and DRES Energy Private Limited, India in which DRL held 26.0 per cent stake.

Ipca Laboratories had two Joint Ventures – Avik Pharmaceutical Limited (India) with 50.0 per cent holding, and Lyka Labs Limited (India) with 36.34 per cent holding (up from 31.36 per cent in FY23). Ipca had acquired 49.02 per cent shares in Avik Pharma in 2013-14 which is manufacturing APIs, primarily Cortico Steroids and Hormone since 1980, and is considered a pioneer in the manufacturing of steroids in India with two manufacturing units in Vapi (Gujarat). Further, the stake of Ipca went up in 2018-19 due to Rights Issue, and subsequently, Ipca’s stake increased to 50.0 per cent in 2021-22. Lyka Labs Limited was incorporated in 1976 in which Ipca Labs acquired 26.58 per cent stake in 2021-22, and another 4.78 per cent stake in 2022-23. Lyka Labs is engaged in the business of manufacturing and marketing of injectables, lyophilized injectables and topical formulations with manufacturing facility in Ankleshwar (Gujarat).

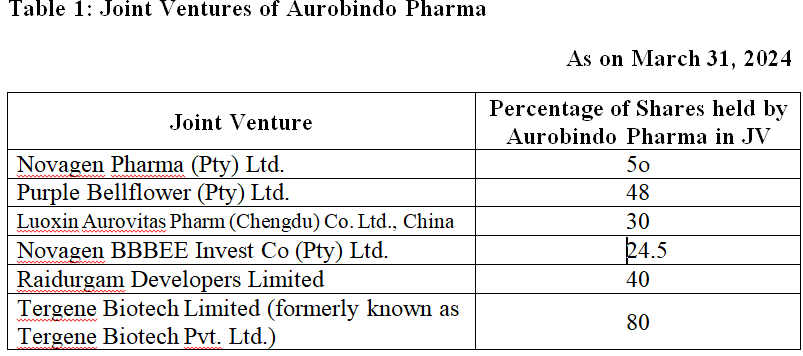

Aurobindo Pharma had the highest number of joint ventures totalling 6 in number by March-end of 2024.

Aurobindo Pharma acquired remaining 52.0 per cent shares from the Joint Venture Partners of Purple Bellflower Pty Limited, South Africa, on April 30, 2024, and it became a wholly owned step-down subsidiary of the company. In this JV, Aurobindo Pharma became 100% owner by making it a step-down subsidiary. In contrast to this, in a recent example of October 2024, Aurogen South Africa (Aurogen), a wholly-owned step-down subsidiary of Aurobindo Pharma sold and disposed of its entire remaining holding to Rene Glyne Family Trust in Novagen BBBEE Invest Co (Proprietary) Limited, a JV. In JV, Aurogen owned 24.5 per cent share, Clinigen SA Pty Ltd owned 24.5 per cent share, and Rene Glyne Family Trust owned 51.0 per cent stake.

One notable characteristic of these JVs remained the focus of pharmaceutical companies which primarily pertained to Drugs & Pharmaceuticals except for Mankind Pharma. Mankind Pharma had three joint ventures namely Superba Buildwell (Partnership firm), Superba Developers (partnership firm), and Superba Buildwell (South) (partnership firm) in which it had ownership interest to the extent of 60.0 per cent, 70.0 per cent, and 70.0 per cent respectively as on March 31, 2024. Principal activities of these JVs involved Leasing Business.

Top Indian pharmaceutical companies had mixed experience regarding JVs in the first quarter of 21st century. Many joint ventures of Indian pharma companies have shown success but there are failures too. Failures have not stopped co-venturers to come together.

In January 2002, Torrent Pharma sold its 50 per cent stake in an equal JV with the then Sanofi-Synthelabo. The transaction was attributed to ‘ongoing changes’ in pharmaceutical industry in India. Another reason for exit from JV was the feeling by co-venturers that the JV was ‘not fit for their future strategies.’

Zydus Lifesciences Limited and Bayer Pharma came together to form a joint venture – Bayer Zydus Pharma Private Limited (BZPPL) on January 28, 2011 in which each party held 50 per cent stake. JV was formed for the sales and marketing of pharma products in India as Zydus had strong Indian marketing, sales expertise, wide distribution reach and rich industry network, and Bayer had global expertise in commercializing novel products. This JV made progress in various therapies including cardiovascular diseases, diabetes, women’s health, oncology, and ophthalmology. In April 2018, Bayer increased its ownership interest to 75 per cent. On May 2, 2024, Bayer secured full ownership of the entity as per pre-agreed JV terms.

Parties to a JV may not be on same page while exploring a collaborative opportunity as it was evident when Dr. Reddy’s Labs (DRL) and Fujifilm Corporation signed a Memorandum of Understanding (MoU) on July 28, 2011 with stated objective of an exclusive partnership in the generic drugs business for the Japanese market. For this purpose, both parties agreed to establish a JV in Japan. In pursuance of this MoU, both parties conducted detailed studies for setting up of a JV for developing and manufacturing generic drugs in Japan. In the meantime, priorities changed as Fujifilm realigned its long-term growth strategy for their pharma business. This led to a mutual agreement to terminate the MoU in June 2013. Both parties kept the option to explore alliance opportunities in areas such as active pharmaceutical ingredient (API) development and manufacturing, and development and marketing of super-generics open.

Sun Pharma and Merck Sharp & Dohme (MSD) formed a JV in 2011 to develop, manufacture, and commercialize new combinations and formulations of innovative and branded generics for emerging markets. In February 2016, both parties decided to dissolve the JV. Dissolution was attributed to the changes in the strategic priorities of both the parent companies. Sun Pharma and MSD continued their collaborative arrangement of co-marketing for sitagliptin and the licensing deal on MSD’s experimental skin disease drug tildrakizumab.

Jubilant Biosys, a wholly-owned subsidiary of Jubilant Life Sciences had formed a JV namely ‘Vanthys Pharmaceuticals’ with Eli Lilly in late 2008 with each party holding 50 per cent stake. JV Partners came together to develop molecules from the ‘pre-clinical to phase II stage’ across various segments such as oncology, cardiovascular and diabetes. In January 2012, JV partners agreed to call off their drug-discovery partnership.

Netherlands-based Cipla Holding BV, a wholly owned subsidiary of Cipla announced a JV agreement in December 2016 with Ahran Tejarat Company of Iran in which Cipla’s subsidiary was to hold 75 per cent stake. Regulatory approvals could not be obtained by March 29, 2017, and due to lapse of this condition, the JV agreement was terminated with mutual consent of the parties.

To conclude, it can be said that the real trick in constructing a successful JV is to increase the payoffs to cooperative behaviour. When companies do not find it happening then their choice is to part ways.

Dr. Anil Kumar Angrish-Associate Professor (Finance and Accounting), Department of Pharmaceutical Management,NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.