The GDP numbers for the last financial year, 2022–23, announced last week, have granted the Modi government an extension of its nine-year achievements. According to the data, the Indian economy has achieved a growth rate of 7.2 percent during this period, which surpasses the forecasts of many prominent global institutions such as the IMF, World Bank, etc. Additionally, it has exceeded the Modi government’s own expectations. With this figure, India appears to be on track to become the world’s third-largest economy in the next decade. Since GDP is defined by data, there are diverse opinions and analyses on this matter. Criticism also arises regarding the fact that the economic growth rate in 2021–22 was over 9 percent, which has now decreased to 7 percent. This reality should be viewed in a broader context since the annual growth rate was negative for the first time in 40 years due to the impact of the COVID-19 pandemic in 2020–21, and the subsequent increase was unexpected and justified

If the GDP data is divided into different parts and analyzed, five facts are worth mentioning. Firstly, the agriculture sector has achieved a growth rate of 4 percent, which is higher than the previous financial year. It has seen an increase in four consecutive quarters, with the highest growth rate of 5.5 percent occurring in the January to March quarter. This also indicates that the yield of both Rabi and Kharif crops was very good last year. Of course, this is good news for a country with a large population like India.

The second fact is that the services sector has once again retained its reins in the economy and achieved a growth rate of 28.3 percent. The positive aspect here is that the financial and real estate sectors have now strengthened their hold in society. There has been an increase of about 3 percent compared to last year, which will bring a new outlook to many dimensions in the coming years.

The third positive aspect is that the ‘core sector’ of the economy, which comprises eight segments – coal, crude oil, natural gas, refinery, fertilisers, steel, cement, and electricity – has achieved a staggering growth rate of 7.6 percent. The highest increase has been observed in the coal sector, with a growth of about 15 percent. Apart from coal, electricity, steel, and cement play important roles in the development of society’s infrastructure. The available data shows that, along with coal, the remaining three sectors have also achieved growth rates of more than 8 percent. This serves as direct proof that the Indian economy is rapidly advancing in terms of infrastructure development. However, crude oil alone has registered negative growth rates, which can be largely attributed to the prolonged rise in global crude oil prices during the previous year due to the war between Russia and Ukraine.”

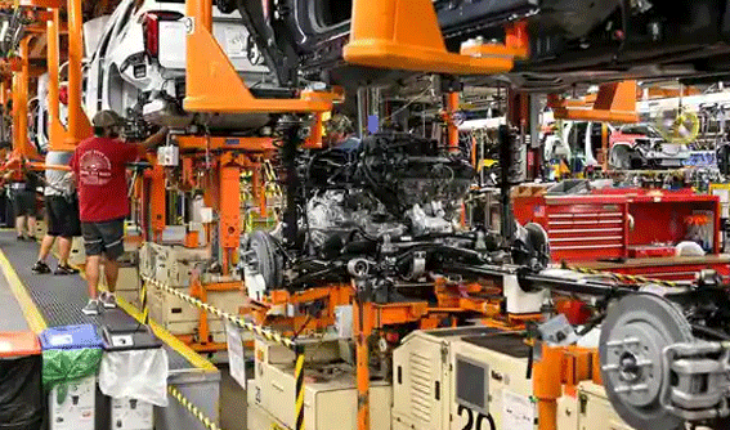

The fourth fact raises a cause for concern for the manufacturing sector as the sector has only been able to achieve a growth rate of 1.3 percent, compared to 11 percent in FY21–22. The surprising aspect is that while all other sectors of the core sector are experiencing growth, why is the manufacturing sector underperforming? In the second and third quarters, there were negative growth rates of 3.8 and 1.4 percent respectively, despite the constant announcements of new schemes for the manufacturing sector by the Modi government. One such scheme includes an investment of approximately Rs. 2 trillion under the PLI scheme. This indicates that the budgetary promotion of the manufacturing sector by cutting the social welfare scheme MGNREGA does not appear to be as effective on the ground.

Fifth, the economy has shown a positive attitude towards investment, which indicates that both the government’s capital expenditure and private financial investment in various development schemes have increased. According to the data, the government’s capital expenditure in the fourth quarter was approximately 2.46 trillion rupees. It has also been observed that currently, government and private financial investment accounts for 34 percent of GDP, the highest level in the last nine years of the Modi government. As a result, various private projects in India are experiencing greater recovery compared to the past decade, which is very positive for the economy.

An analysis of GDP data for 22–23 also reveals that the positive increase in per capita purchasing power is not very encouraging. India, the world’s most populous country, is putting in great efforts to continuously boost its economic growth rate. However, is it not too little to increase the per capita purchasing power by just 2.8 percent? This situation presents a contradiction with the economic growth figures: the wealthy are spending more in the economy, while the consumption capacity of the poor remains stagnant. The reason behind this is that the purchase of luxury goods and high lifestyle-related expenses only contributes to a single aspect of the increase in per capita purchasing capacity, which exclusively benefits the economically affluent class. Furthermore, it has also been observed that tractor sales have increased, but two-wheeler sales have not, indicating that lower-income individuals are still managing their purchasing capacity, with their primary goal being an increase in their financial income. This situation underscores the clear imbalance in the distribution of economic income within society, as evidenced by the data on ever-growing economic inequality. In summary, it can be concluded that in the future, there will undoubtedly be an increase in economic expenditure on social welfare schemes, enabling the lower class to become part of the mainstream economic growth.

Dr. P.S. Vohra , Academician, Financial Thinker & Newspaper Columnist , Views are personal