Understanding the connect between the value and the source of the value of any asset remains important for investment in assets as well as successful management of assets. Market Approach to Valuation is based on the ‘principle of substitution’ under which it is assumed that the price of an asset will be only the cost of acquiring an equally desirable substitute. So, the price of an asset is based on the prices which have been paid for similar assets in the relevant market place. Under the Market Approach, Relative Valuation method or Comparable Company Approach lays emphasis on identification, and pricing of an exact identical firm in terms of cash flows, growth rate, and risks. Instead of capturing intrinsic value, relative valuation reflects the current mood of the market.

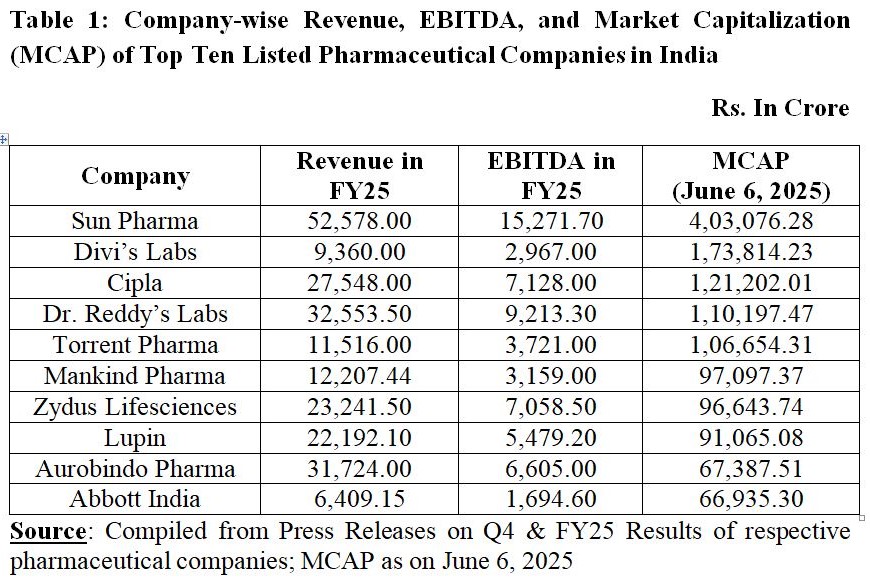

Revenue multiple measures the value of the equity or the business relative to the revenue generated. Revenue multiple is one of the widely used measure in Valuation, and this holds true for pharmaceutical sector as well. Table 1 shows the revenue, Earnings before Interest, Tax, Depreciation, and Amortisation (EBITDA), and market capitalisation (MCAP) of top ten pharmaceutical companies in India. For Sun Pharma, which is number one pharma company in terms of MCAP, market share, revenue, as well as EBITDA, M-Cap is 7.66 times of revenue. In contrast to this, MCAP of Divi’s Labs is 18.56 times of revenue of the company which is the highest among top 10 pharma companies in India. For other top pharma companies in India in terms of market capitalisation, MCAP to Revenue multiple varies from a low of 2.12 times for Aurobindo Pharma to a high of 10.44 times for Abbott India: Aurobindo Pharma (2.12), Dr. Reddy’s Labs (3.38), Lupin (4.10), Zydus Lifesciences (4.16), Cipla (4.39), Mankind Pharma (7.95), Torrent Pharma (9.26), and Abbott India (10.44).

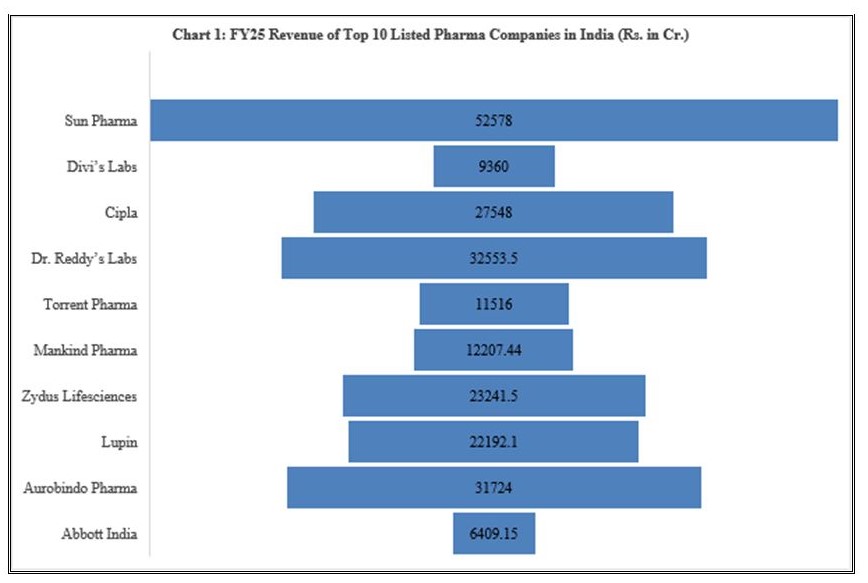

Correlation is positive (0.67) between revenue of top ten pharma companies in FY25, and their MCAP. Sun Pharma had the highest revenue as well as MCAP among pharmaceutical companies in India. Abbott India had the lowest revenue among top 10 pharma companies in India, and it had the lowest MCAP too. Divi’s Labs is ranked 9th in terms of revenue whereas in terms of MCAP, it is ranked 2nd among pharmaceutical companies in India.

Correlation is positive (0.76) between EBITDA of pharma companies in FY25, and their MCAP. Sun Pharma had the highest EBITDA as well as the highest MCAP among pharmaceutical companies in India. EBITDA was the lowest for Abbott India in FY25, and MCAP of the company was also the lowest among top 10 pharma companies. For FY25, Cipla is ranked 3rd in EBITDA as well as MCAP. DRL is ranked 2nd in terms of Revenue and EBITDA but ranked 4th in MCAP for FY25. In contrast to this, Divi’s Labs is ranked 9th in terms of EBITDA whereas in terms of M-Cap, it is ranked 2nd among pharmaceutical companies in India.

Most of these pharma companies are cash-rich companies, and have low debt-equity ratio. There are exceptions too. Among top 10 pharma companies, Mankind Pharma acquired 100% stake in Bharat Serums and Vaccines Limited (BSV), for a purchase consideration of Rs. 13,768 Crores. The transaction was funded through a combination of internal accruals and external debt of about Rs. 7,000 Crore that comprised Non-Convertible Debentures and Commercial Papers. Mankind Pharma recognized this transaction as EBITDA margin-accretive acquisition. Even with the debt, Mankind Pharma is likely to maintain a Net Debt to EBITDA ratio below 2x by FY26. Mankind Pharma took debt for the first time, as founders have always been averse to taking debts.

Source: Compiled from Press Releases on Q4 & FY25 Results of respective pharmaceutical companies

For Sun Pharma, MCAP stood at 26.39 times of EBITDA. In contrast to this, MCAP of Divi’s Labs on June 6, 2025, stood at 58.58 times of EBITDA of the company for FY25 which is the highest among top 10 pharma companies in India. For other top pharma companies in India in terms of market capitalisation, MCAP to EBITDA multiple varies from a low of 10.20 times for Aurobindo Pharma to a high of 39.49 times for Abbott India: Aurobindo Pharma (10.20), Dr. Reddy’s Labs (11.96), Zydus Lifesciences (13.69), Lupin (16.62), Cipla (17.0), Torrent Pharma (28.66), Mankind Pharma (30.74), and Abbott India (39.49).

Like any other sector, in addition to Revenue and EBITDA of companies, company-specific variables influence the valuation as even top pharmaceutical companies in India vary significantly from each other. The parameters for consideration of differences among pharmaceutical companies include product profile, markets served by these pharmaceutical companies, expected growth rate of their segments, scale of their operations, their cost structures, technology used by respective pharma companies, etc. Pharma companies in India along with their subsidiaries earn revenue from different geographic areas, and from different therapeutic categories. Geographic territories, and therapeutic categories vary substantially in contribution to EBITDA of respective pharma companies. Recent examples explain these parameters to acknowledge these differences.

At the time of acquisition of BSV by Mankind Pharma, growth rate of Bharat Serums and Vaccines (BSV) was in the range of 15-20% versus Mankind Pharma’s growth rate of 12%. EBITDA of Mankind Pharma was in the range of 25-26% whereas EBITDA of BSV was in the range of 28-30%.

Pharma companies keep on identifying new growth drivers, e.g., in August 2024, Zydus Lifesciences signed an agreement with Perfect Day Inc., a Temasek portfolio company, to acquire about 50 per cent shareholding in Sterling Biotech Limited. This agreement marked Zydus’s foray into specialized biotech products for health and nutrition, specifically catering to consumers who prefer animal-free protein or suffer from lactose intolerance. Precision-fermented protein has application in cream cheese, ice creams, sports nutrition products, and baked goods. On March 11, 2025, Zydus Lifesciences announced that the company had entered exclusive negotiations to acquire a controlling stake in France-based medtech firm Amplitude Surgical SA for €256.8 mn to foray into the global medical devices market. Zydus recognized opportunity for growth of medical devices, and is eyeing three segments namely orthopaedics, interventional cardiology and nephrology. Zydus had acquired a facility for manufacturing stents too. The company has plans to leverage its global presence in pharmaceuticals to launch its medtech play.

Revenue and EBITDA of pharmaceutical companies positively contribute to MCAP of pharmaceutical companies in a significant manner. Chart 2 highlights the relationship of MCAP with Revenue, and EBITDA of top 10 pharmaceutical companies in India.

From above, it is apparent that pharma sector-specific multiple cannot be representative as pharma companies differ widely, and further, sector-specific multiples have their own limitations, e.g., one will find it difficult to relate sector-specific multiples to fundamentals. General profile of pharma industry, demand-supply position, competitive structure of the industry within the country and outside India where Indian pharma companies export, pricing system such as products brought under the price control due to changes in the National List of Essential Medicines (NLEM), availability of Active Pharmaceutical Ingredients (APIs), Key Starting Materials (KSMs), and Drug Intermediates (DIs), reliance of respective pharma companies on imports of APIs/KSMs/DIs or on captive capacity, regulatory framework, governments policies, etc. have their implications for the industry as a whole, or for specific pharma companies.

One can observe this from recent changes in prices of certain APIs. Recent reports show that prices of six APIs dropped sharply, e.g., the price of paracetamol dropped to Rs. 250 from the high of Rs. 900 per kg during Covid-19, Similarly, price of other products such as Sitagliptin dropped to Rs. 5,000 (from Rs. 5,900 in 2024), Vildagliptin to Rs. 4,800 (from Rs. 5,300 in 2024), Melitracen to Rs. 13,300 (from 14,500 in 2024), Fusidic Acid to Rs. 38,000 (from Rs. 44,000 in 2024), and Deflazacort to Rs. 70,000 (from Rs. 1,00,000 in 2024). This drop in prices is likely to affect pharma companies differently, e.g., users of these APIs in their formulation, manufacturers of these APIs, those who are in the process of capacity expansion of these APIs within country, etc. In turn, this will affect revenue, and EBITDA of respective pharma companies. Finally, MCAP of respective pharma companies will be affected.

Revenue multiple, and EBITDA multiple appear relevant in valuation of pharma companies despite of limitations such as non-consideration interest, maintenance capital expenditure, i.e., depreciation, amortization, etc. Analysis regarding top pharmaceutical companies in India also suggest that revenue and EBITDA cannot be ignored while looking at market capitalisation.

Dr. Anil Kumar Angrish-Associate Professor (Finance and Accounting), Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.