The socio-economic welfare policies of Rajasthan are being discussed all over the country, these days. Is this an electoral politics of the Gehlot government? Has this caused a setback to the economic development of Rajasthan? Many such questions are constantly in discussion. In any democracy, the main responsibility of the government is to take the society towards economic prosperity, while there is also the economic welfare of the deprived class from the mainstream. It is a quandary in which drawing the right line is a very difficult task as both economic prosperity and social welfare are opposite to each other. It is an imaginary ideology that everyone will achieve 100% economic prosperity , therefore, under the democratic system, responsible attitude can be adopted only with the thought that backward and poor sections should always get priority in economic policies. Surely, the government itself takes the initiative to create and develop resources for economic prosperity and there are equal opportunities for the private sector as well. This aspect of economic policies gives rise to capitalist ideology. This is also true that economic prosperity ultimately gives birth to economic inequality. However, from a positive perspective, if we think about it, this is also a context where whoever has transformed opportunities into profitability and has undoubtedly taken risks as well.For this reason, in this era of globalization, it has become an established belief that economic prosperity should be handed over to the private sector, and the responsibility of social welfare, which is actually the economic development of the poor and marginalized sections of society, has to be shouldered by the government.

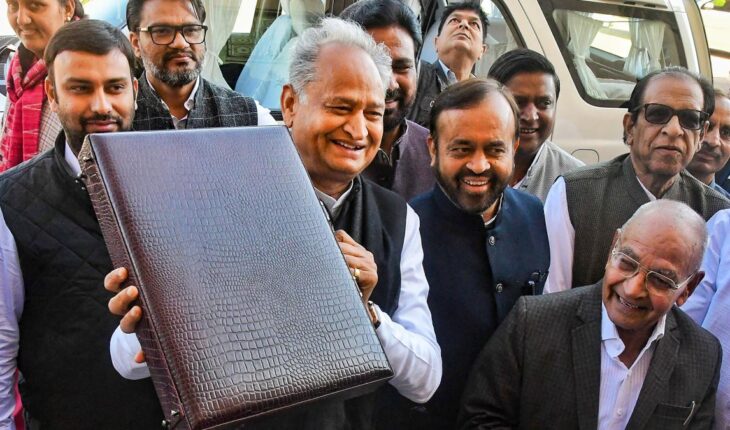

The social welfare policies of the current Gehlot government in Rajasthan gained more attention when they reversed the central government’s new pension scheme, which had been in effect since 2004, in the 2021-22 financial budget. They reinstated the old pension scheme for government employees in Rajasthan. Under the new pension scheme, government employees were required to contribute 10% of their salary, which will no longer be the case in Rajasthan. Furthermore, by passing the Right to Health Bill related to the right to health, the government faced opposition from private hospital owners, doctors, and employees for an extended period. Rajasthan’s Chief Minister’s Chiranjivi Health Insurance Scheme also received significant attention, under which the government provided facilities for medical tests and free treatment, and in the current financial year’s budget, the government increased the insurance amount per family in this scheme from 10 lakh rupees to 25 lakh rupees. Undoubtedly, these social welfare schemes of the Gehlot government have imposed a greater financial burden on the state. Criticism is also being raised that due to these economic policies of social welfare, the state will face financial difficulties in the future.

Despite all this, the figures of Rajasthan’s economy indicate a different state of economic development. If we talk about fiscal deficit, then in the last 5 years, it has increased by only .03 percent. The maximum deficit was 5.9 per cent in the year 2020-21 affected by the Corona epidemic, which was more than the average fiscal deficit of all the states of India.On the other hand the maximum fiscal deficit during the tenure of the previous government was 9.2 per cent. It is also important to mention here that after Corona, the fiscal deficit in all other states has come down to less than 0.6 percent, while in Rajasthan it has come down to less than 1.9 percent. This proves that Rajasthan has made a remarkable economic recovery after Corona. In terms of revenue generated from its own sources, the state has recorded an average GDP growth of 14.7 percent in the past 5 years, and from 2018-19 to 2022-23, it has experienced a growth rate of 1.5 percent. On the other hand, during the previous government’s tenure of 5 years, this growth was only 0.08 percent. It is noteworthy that during both the previous governments’ terms, Rajasthan has consistently been ahead in terms of its own sources of revenue generation in the country.

Rajasthan has witnessed an increase in the revenue generated through its own sources of taxation in the past 5 years. In 2017-18, these taxes accounted for 62 percent of the state’s GDP, which has now increased to 67 percent in the year 2023. This fact proves that Rajasthan is progressing towards self-sufficiency in tax collection from its own income sources. Despite these achievements, there have been two negative aspects regarding the economic development of the state. First, the state’s capital expenditure is comparatively lower than that of other states. Second, there is higher expenditure on various types of subsidies compared to other states. However, based on the current figures related to these two aspects, Rajasthan has been making efforts to improve its relative position in the past few years. For instance, in the year 2018-19, the state’s subsidy bill accounted for 12.9 percent of the GDP, while the average for all other states was 7.1 percent. By the year 2021-22, this percentage decreased to 10.5 percent in Rajasthan, whereas the average for other states increased to 9.7 percent. This analysis also suggests that in the year following the recovery from the COVID-19 pandemic, the subsidy burden has decreased to less than 0.04 percent on average for all other states, while Rajasthan’s subsidy bill has increased to 2.2 percent. This increase is clearly influenced by the political dynamics of Rajasthan’s election year. In terms of capital expenditure for economic development, in the year 2022-23, Rajasthan’s GDP allocation was 15 percent, while the average for all other states remained at 20 percent. This is not ideal for Rajasthan’s economic development as lower investment in capital expenditure leads to a decrease in the creation of new assets. However, it is important to note that in comparison to the past 7 years, Rajasthan has the highest capital expenditure. Furthermore, since the percentage of taxes generated from the state’s own sources is consistently increasing, it is certain that Rajasthan’s investment in capital expenditure will also increase in the coming years.

Investment in education is a gateway to economic prosperity. In relation to the state of Rajasthan, it is crucial to note that there has been significant investment in the field of education compared to all other states and centrally governed territories of India over the past 5 years. The confirmation of this fact can be seen in the various financial budgets undertaken by the Rajasthan government, which clearly prioritize the expansion of school education and higher education, aiming to make Rajasthan a central hub for education in the future. In terms of healthcare facilities as well, Rajasthan has consistently seen higher financial investments compared to all other states and centrally governed territories in India. The conclusion drawn from all these observations emphasizes the need to integrate economic policies with the goal of providing individuals with high-quality essential amenities, thereby contributing to the state’s exemplary economic model.

Dr. P.S. Vohra , Academician, Financial Thinker & Newspaper Columnist , Views are personal