By Dominick Rodrigues

The Consulting Engineers Association of India (CEAI), an apex body of Consulting Engineers in India, has appealed to the Prime Minister Narendra Modi for a “re-look” at its Goods and Services tax (GST) and Tax Deduction at Source (TDS) collection regime for the Consulting and Services Community, and to allow the sector to deposit GST and TDS after receipt of payments from clients.

The CEAI, in a letter to the Prime Minister, stated “At present, Consultants pay their taxes as conscientious Professionals and Firms, but feel utterly frustrated as both Goods & Services Tax (GST) and Income Tax Deducted at source (TDS) have to be deposited on Accrual and Due basis. Goods & Services Tax (GST) has to be deposited within 30 days of raising of Invoice, and not on receipt of our dues from the Customer/Client.”

Amitabha Ghosal, President, Consulting Engineers Association of India (CEAI), stated in the letter “The Consulting engineering companies are engaged in the Service Sector and are totally dependent for survival on timely receipt of dues from the clients. Banks are reluctant to advance finance to Professionals and, in any case, are averse to funding payment / deposit of GST and Income Tax. Delays in receipt of dues from clients adversely affect our financial situation, leading to delays in deposit of GST along with interest.”

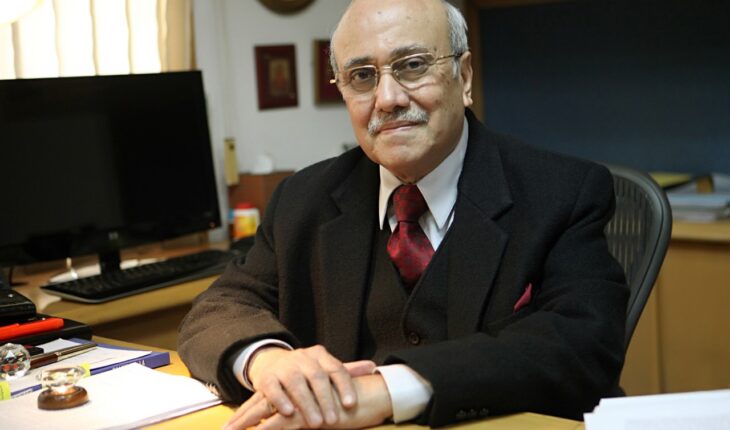

“Any delay in deposit of GST leads to threats of Cancellation of GST Registration and/or Prosecution, etc. This is in spite of the fact that we pay interest on delayed deposit of GST— even in our tight Liquidity situation. Similarly, the Tax Deduction at Source (TDS) has to be deposited on time by the 7th of the subsequent month, irrespective of non-receipt of dues by a Professional Firm from its clients. Due to financial limitations, there arise situations of delayed deposit of TDS. Here again, in spite of depositing TDS along with interest, we are subject to receipt of Prosecution Notices from the Income Tax department,“ said K K Kapila, Chairman, CEAI, Infrastructure Committee.

“The Consulting Engineers have urged the Hon’ble Prime Minister to intervene and direct the Finance Ministry not to initiate prosecution proceedings against such law-abiding firms/professionals, unless malafide intentions are blatantly visible. Equating all Service Providers and their business requirements as similar is a very +myopic+ approach. For instance, an Infrastructure Consultant – who, as part of the Service Sector — contributes immensely to the development of the country and also earns valuable FOREX reserves, and is required to pay GST within 30 days of raising invoice — months ahead of getting the actual payment from the Client. A Shopkeeper, who is also part of the Service Sector network, gets immediate payments as soon as a sale is done and therefore, it is possible for him to pay the GST in the 30 day cycle,“ Kapila said.

“Consulting Engineers have requested the Prime Minister to help the consulting community by facilitating a more customised and positive approach to various stakeholders of the Service Sector network, so that the ultimate objective of revenue generation is achieved — without distress to anyone. An urgent correction is needed to save the Consultancy Sector, which is on the verge of collapse. The consulting firms in the service sector should be permitted to deposit GST and Tax Deducted at Source on payment receipt Basis,“ Kapila said, adding “The above suggestions will help the Consulting Companies to tide over the problems of payment of GST/TDS to the Government and relieve their financial burden, besides also helping the Government to collect tax revenues effectively.”