Exports of drugs and pharmaceuticals from India in FY25 stood at US $30.47 Bn, i.e., Rs. 2.58 Lakh Crore in rupee terms. In dollar terms, pharma exports grew by 9.67 per cent in FY25, whereas in rupee terms, the growth rate was 11.86 per cent. Corresponding figure for pharma exports in FY24 was $27.85 Bn (or Rs. 2.30 Lakh Crore in rupee terms). In contrast to this, the domestic pharma market touched Rs. 2.26 Lakh Crore revenue in FY25 with a growth in volume of 0.4 per cent (India Ratings), and 8.4 per cent value growth (Pharmarack). Growth in overall pharma exports as well as domestic pharma was expected to positively contribute towards increase in top pharma companies’ revenue as well as Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA).

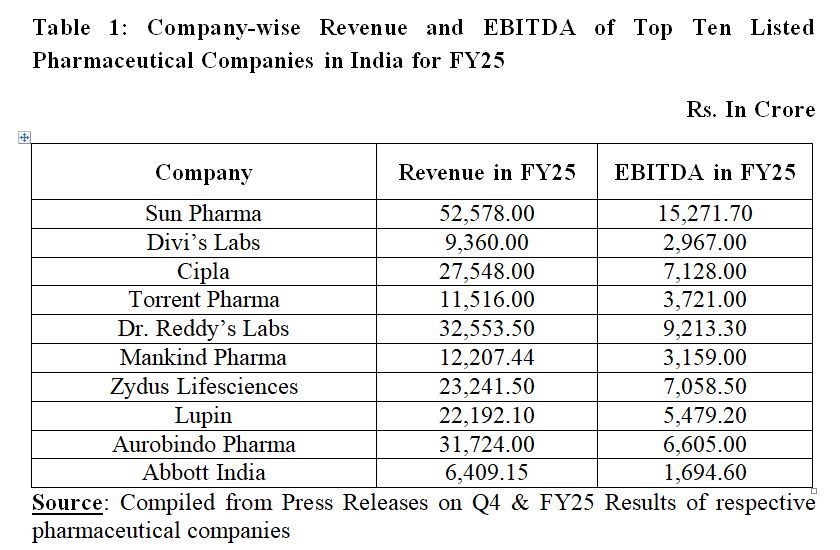

Listed pharmaceutical companies declared their Q4 and Annual Results for FY25. Financials reported by these pharmaceutical companies reflected positive signs on profitability aspect. For top ten listed pharmaceutical companies, improvement has been observed in the revenue from operations, EBITDA margin, as well as Net Profits. Most of these companies have significant presence in India as well as in foreign markets. Improvement in key profitability measures for these 10 companies is important as these companies have maximum share in terms of market capitalization in May 2025, maximum share in terms of market share in the domestic market, and contribute significant share to overall export revenue from pharmaceutical products earned by Indian pharma companies.

Sun Pharma which is the largest pharma company in India, reported Rs. 52,578.0 Crore as the revenue from operations for FY25. This reflected an increase of 8.0 per cent as compared to FY24. Net profits increased by 14.0 per cent Y-o-Y basis. The company reported a decline of 19.0 per cent Y-o-Y decline in its Q4 consolidated net profits, as net profits stood at Rs. 2,149.8 Cr. This decline in quarterly net profits was mainly attributed to an exceptional item. Otherwise, net profit rose by 4.8 per cent to Rs. 2,889.10 Crore. EBITDA stood at Rs. 15,271.70 Crore with an EBITDA margin of 29.0 per cent, and Y-o-Y increase in EBITDA was 17.3 per cent. Sun Pharma had to opt for a legal settlement in the US market, and this was an exceptional item of Rs. 677.8 Crore. The United States Court of Appeal had reversed its earlier ruling that vacated the preliminary injunction. On domestic front, the company’s formulation sales stood at Rs. 16,923 Crore which reflected an increase of 13.7 per cent Y-o-Y basis.

Divi’s Labs earned a consolidated total income of Rs. 9,712 Crore in 2024-25 as against a consolidated total income of Rs. 8,184 Crore in FY24. Revenue from Operations stood at Rs. 9,360 Crore out of total consolidated total income. Profit after Tax (PAT) stood at Rs. 2,191.0 Crore in FY25 as compared to Rs. 1600.0 Crore for FY24, thereby showing an increase of 36.93 per cent. EBITDA stood at Rs. 2,967 Crore for FY25 (up from Rs., 2,203 Crore for FY24), and EBITDA margin was 31.7 per cent, up from 28.1 per cent in FY24.

Cipla’s consolidated revenue for FY25 stood at Rs. 27,548 Crore, which was 7.0 per cent as compared to FY24 revenue of Rs. 25,774 Crore. Consolidated Net profit of the company stood at Rs. 5,273 Crore in FY25, up from Rs. 4,122 Crore in FY24 thereby reflecting an increase of 28.0 per cent. Excluding India, the U.S. market remained the largest contributor (28.67 per cent) to Cipla’s revenue, and contributed Rs. 7,899 Crore which was higher than previous year’s figure of Rs. 7,501 Crore. EBITDA stood at 25.9 per cent, with a Y-o-Y increase of 14.0 per cent.

Torrent Pharma earned a revenue of Rs. 11,516 Crore for FY25, up from Rs. 10,728 Crore for FY24 thereby showing a Y-o-Y increase of 7.0 per cent. The company’s EBITDA stood at Rs. 3,721 Crore which is 32.3 per cent of revenue, and had a Y-o-Y increase of 9.0 per cent. For FY25, India revenue was Rs. 6,393 Crores (up by 13.0 per cent), revenue from Brazil stood at Rs. 1,100 Crores (down by 2.0 per cent), revenue from Germany stood at Rs. 1,139 Crores (up by 6.0 per cent), and revenues from the U.S. business stood at Rs. 1,100 Crores (up by 2.0 per cent)

Dr. Reddy’s Laboratories had the revenue of Rs. 32,553.50 Crore for FY25, with an increase of 17.0 per cent YoY basis. Gross margin of the company stood at 58.5 per cent in FY25 (58.6 per cent in FY24). EBITDA margin of the company stood at Rs. 9,213.30 Crore, or 28.3 per cent of Revenues which was marginally lower than 29.7 per cent in FY24. In absolute terms, EBITDA margin of Rs. 9,213.30 Crore was higher than FY24 figure of Rs. 8,301.30 Crore. Improvement in EBITDA margin was reflected in Profit after Tax (PAT) too as it went up by 2.0 per cent YoY basis to touch Rs. 5,654.40 Crore. Growth of 18.0 per cent was observed in Global Generics, followed by 14.0 per cent growth in Pharmaceutical Services and Active Ingredients (PSAI). Contribution of North America in Global Generics business stood at Rs. 14,516.40 Crore thereby forming 50.13 per cent of total Global Generics business.

Mankind Pharma earned a revenue of Rs. 12,207.44 Crore for FY25, up from Rs. 10,260.44 Crore for FY24 thereby reflecting a growth of 18.97 per cent. Domestic revenue of Rs. 10,675 Crore formed major chunk of the total revenue for FY25 with YoY increase of 13.0 per cent. Profit after Tax for FY25 stood at Rs. 2,006.59 Crore as against Rs. 1,940.79 Crore thereby showing a growth of just 3.39 per cent. Mankind Pharma had successfully acquired 100 per cent stake in Bharat Serums and Vaccines Limited (BSV) for a purchase consideration of Rs. 13,768 Crores. Adjusted EBITDA stood at Rs. 3,159 Crore. EBITDA margin was 25.9 per cent up by 130 bps YoY basis. One time adjustment was made for M&A & Integration cost related to BSV and other non-recurring costs.

Zydus Lifesciences earned revenue from operations amounting to Rs. 23,241.50 Crore for FY25, up 18.0 per cent over FY24. EBITDA for FY25 stood at Rs. 7,058.50 Crore, with YoY increase of 31.0 per cent. EBITDA margins stood at 30.4 per cent, with an improvement of 290 bps over FY24. Net Profit for FY25 stood at Rs. 4,745.10 Crore, up from Rs. 3,873.70 Crore for FY24 thereby reporting the growth of 22.5 per cent. The US Formulations contributed 49.0 per cent to the consolidated revenues for FY25. India Geography was next major contributor with a contribution of 38.0 per cent to the consolidated revenues for FY25.

Lupin Limited reported a Net Sales of Rs. 22,192.10 Crore for FY25, up from Rs. 19,656.30 Crore in FY24 thereby reflecting a growth of 12.9 per cent YoY basis. Net Profit improved from Rs. 1,914.50 Crore in FY24 to Rs. 3,281.60 Crore in FY25. EBITDA increased from Rs. 3,930.70 Crore in FY24 to Rs. 5,479.20 Crore in FY25 thereby showing a strong growth of 39.4 per cent. As a result, EBITDA margin touched 24.69 per cent in FY25, up from 20.0 per cent EBITDA margin in FY24.

Consolidated revenue of Aurobindo Pharma stood at Rs. 31,724 Crore for FY25, up from Rs. 29,002 Crore for FY24, thereby showing a YoY increase of 9.4 per cent. Gross margin also increased to 58.9 per cent in FY25, up from 56.5 per cent in FY24, with a YoY increase of 14.6 per cent. Improvement was observed in EBITDA too as it improved to Rs. 6,605 Crore in FY25, up from Rs. 5,843 Crore in FY24 with YoY increase of 13.0 per cent. EBITDA margin stood at 20.8 per cent in FY25, up from 20.1 per cent in FY24.

Abbott India had an annual revenue of Rs. 6,409.15 Crore for FY25, up from Rs. 5,848.91 Crore in FY24. For FY25, the company reported a net profit of Rs. 1,414.44 Crore, up from Rs. 1,201.22 Crore in FY24, thereby marking an increase of 17.7 per cent. EBITDA Margin also increased to 26.4 per cent for FY25, up from 24.8 per cent in FY24.

To conclude, FY25 ended on a positive note for top ten pharma companies in terms of growth in revenue – Sun Pharma (8.0%), Divi’s Labs (18.67%), Cipla (7.0%), Torrent Pharma (7.0%), Dr. Reddy’s Labs (17.0%), Mankind Pharma (18.97%), Zydus Lifesciences (18.0%), Lupin (12.9%), Aurobindo Pharma (9.4%), and Abbott India (9.58%). EBITDA margins improved for 9 out of top 10 pharma companies namely Sun Pharma (29.0%), Divi’s Labs (31.7%), Cipla (25.9%), Torrent Pharma (32.3%), Mankind Pharma (25.9%), Zydus Lifesciences (30.4%), Lupin (24.69%), Aurobindo Pharma (20.8%), and Abbott India (26.4%). A marginal decline was observed in EBITDA margin for Dr. Reddy’s Labs from 29.7% to 28.3%.

Dr. Anil Kumar Angrish-Associate Professor (Finance and Accounting), Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.