Mumbai: Gopal Snacks Limited announced its Initial Public Offering (IPO) priced at Rs 381-401 per equity share – aggregating to Rs 650 crores – which will open on March 6 and close on March 11, 2024.

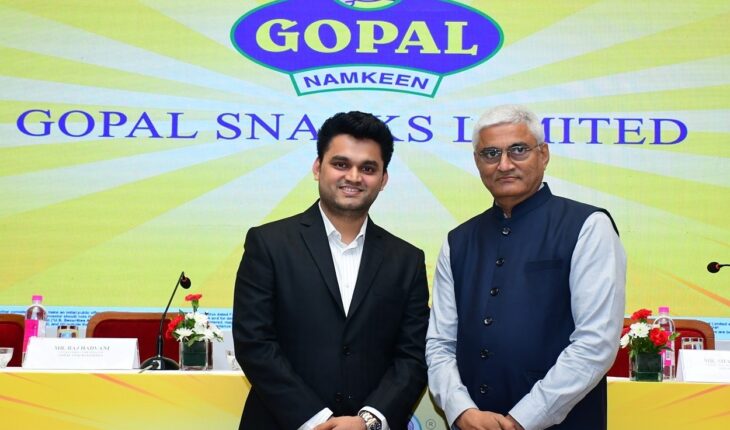

Bipin Hadvani, Chairman and Managing Director, Gopal Snacks Limited, said the snacks industry in India is worth Rs 45,000 crores and expected to grow at CAGR of 11.70%.

He said the company manufactures 84 savoury products and, besides supplying the Indian market, exports them to countries like UAE, USA, Australia, Kuwait and Saudi Arabia.

The company’s entire business is done in online mode, and all its production and manufacturing units are built by the company itself, he said, adding that 72% of its revenue comes from Gujarat itself.

The company’s Revenue from Operations for FY23 was Rs 6,761 crores, while EBITDA for H1Sept 2023 was 942.64.

Hadvani said this IPO is only for debt repayment, while the company’s growth strategy is for: continuing to develop and launch new products, focus on capturing the market share in wafers/chips category, which has an estimated market size of between Rs 30-35 billion in Gujarat itself, as of FY2023.

“We will continue to expand our wallet share with consumers and grow the customer base,” he said, adding that the company is looking at deeper penetration in Gujarat by leveraging the existing distribution network of 279 distributors, as this State is the “core” market for Gopal Snacks Limited.

“We aim to optimize the unutilized capacity to meet the growing product demand and increase our market share in the focus markets through efficient marketing initiative, while also creating brand awareness and incentivizing distributors about our products,” he added.

The BRLMS to the issue are: Intensive Fiscal Services Private Limited, Axis Capital Limited and JM Financial Limited.